Developing economies will get a broadband boost

Just as Africa’s demand for data has outpaced the international bandwidth available, the region has been plagued by submarine cable faults, says international researcher Telegeography. The good news is that there are eight new cables planned that could relieve the congestion and provide a bypass to any blockages in the data shipping channels, reported Patrick Christian, who described the new additions putting Africa on the Submarine Cable map.

Cabling up Africa is easier that it used to be, according to Chris Wood, CEO of WIOCC Group, one of the original investors in the EASSy submarine cable system on Africa’s east coast. However, it is still a dangerous business. WIOCC was an early pioneer of markets that most companies wouldn’t go near such as Somalia, where it will operate the landing station for the 2Africa cable (see below). The company landed the EASSy cable in Mogadishu in 2012, which Wood said was “not a trivial exercise”. It took five years of preparatory work and involved French naval support and Ugandan troops provided by the African Union to protect its workers and contractors.

Risk asde, the rewards promise to be immense. The PEACE Cable is to run along the East Coast cable and is scheduled for completion before 2023. The PEACE Mediterranean segment originated in 2022 Marseille and links Malta, Cyprus, and Egypt. The original idea for the cable was to run 12,000 kilometres spanning from Pakistan to France, reaching countries down the east coast of Africa, the Middle East, and the Mediterranean. However, there is a welcome complication, with the addition of Singapore to the planned route, but that involves finding and laying an extra 9,500 kilometres of fibre.

On the West Coast of Africa, Côte d’Ivoire, Ghana and Nigeria have been identified as the three most attractive African investment destinations in a new Deloitte survey that was released at the Africa CEO Forum, which took place in Abidjan last week. To cater for that, a Google project Equiano involves a private cable that will connect several countries along the West Coast of Africa. One of the partners, WIOCC recently completed a fibre network over Nigeria’s national network of power lines to interconnect the major cities in the West African nation. It now plans to invest further in data centre infrastructure in those cities. The company has also landed the Equiano cable in the former capital Lagos, with plans to expand its data centre there to 20MW of load to cater for growing demand. Port Harcourt and Abujan, the new capital city, will likely be the next cities it expands to, said WIOCC CEO Wood. It is looking, too, at the possibility of hosting a second landing station for Equiano.

The first sections could begin service in 2023. It will start in Portugal and reach down to South Africa via Togo, Nigeria, St. Helena, and Namibia.Expect services to start in 2023, with additional landing points added later. The 2Africa system will link 33 African, Asian and European countries via 45,000 kilometers of cable that will encircle Africa with fibre. Facebook AKA Meta is funding and project managing it through a consortium that includes China Mobile, MTN, Orange, Saudi Telecom, Telecom Egypt, Vodafone and WIOCC.

In South Africa, WIOCC has built a 2MW data centre in Amanzimtoti, south of Durban, ostensibly to host the landing of the 2Africa cable system in the country. 2Africa’s eastern route, between South Africa, Europe and the Middle East, is expected to go live early in 2023. The route will proceed along Africa’s west coast, where Equiano is being deployed, and become available in 2024. WIOCC is also investing in edge data centres along the ‘national long distance routes to help Internet service providers get access to services.

Africa-1 is another consortium-led project, this one is backed by E& (formerly Etisalat), G42, Mobily, Pakistan Telecommunications Company, and Telecom Egypt. Sometime in 2023 it will begin to connect France, Kenya, Pakistan, the UAE and several African and Middle Eastern countries along its way.

Google, Sparkle and OmanTel plan to connect with the Blue Raman cable connecting Djibouti, several other Middle East countries and India to the larger network and onward to Europe. Estimates indicate the cable will be ready by 2024. Another access point connecting Djibouti to the Middle East and India – as well as Greece, and Italy – is The India Europe Xpress (IEX) an initiative run by Indian telco Reliance Jio, along with undisclosed partners, with announced service in 2024.

There is a private AFR-IX endeavour called the Medusa Submarine Cable System which will connect the North African countries of Morocco, Algeria, Tunisia, and Egypt to their northern Mediterranean counterparts, specifically Spain, France, Italy, and Greece (plus Portugal). The launch is planned for 2024 in the Western Med and 2025 in the Eastern Med.

Finally, with 19,200 kilometres of cable spanning France to Singapore, there is the SEA-ME-WE 6 (SMW6) which will reach Africa by landing in Egypt and Djibouti. The consortium responsible for this system plans to begin service in early 2025.

Sub-sea cabling is a lot easier than it was. The piracy problem in Somalia in 2012 was “a thousand times worse” than it is today, according to WIOCC’s CEO Chris Wood. The benefits will be immense. Landing EASSy transformed the telecoms market in Somalia, said Wood.

Two huge subsea cable systems planned by Meta and Google are likely to be game-changers for African telecoms, TeleGeography says.

The continent is undergoing a mini cable boom, with eight subsea systems due to go live in the next two years.

But only Meta’s 2Africa and Google’s wholly-owned Equiano will bring substantial fresh capacity to African telecom hubs, TeleGeography senior research manager Patrick Christian said.

Service is now expected to be commissioned in Q4.

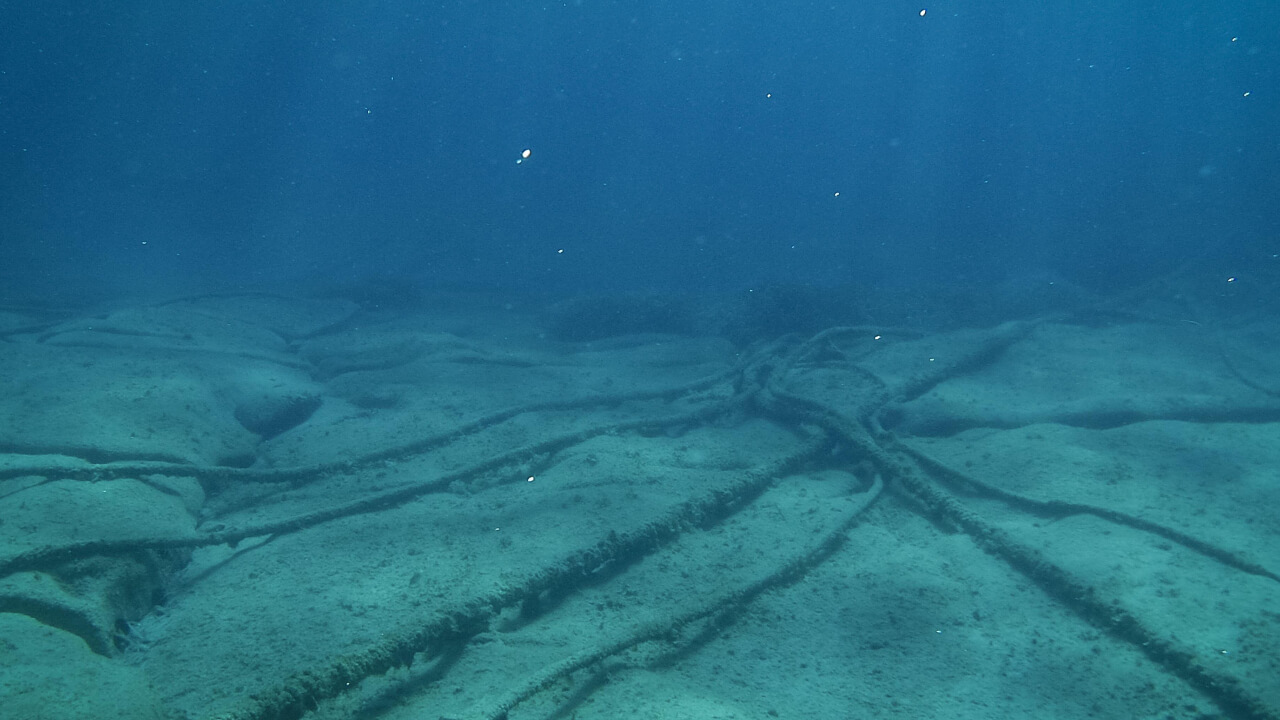

(Source: Sybille Reuter/Alamy Stock Photo)

The others, like the Peace Cable and India Europe Xpress (IEX), will land in just one or two African sites on their way to other destinations.

The two new systems now under construction by the US internet giants are their first in Africa and look set to disrupt the retail and wholesale markets.

“Those are the game-changers that people are watching,” Christian told Light Reading.

Besides adding a torrent of fresh capacity, the two new players would drive competition and would also insist on open access on cable landings and backhaul.

“It’s in their best interests,” Christian said.

Ripe for expansion

The continent is certainly ripe for another round of capacity expansion. It’s had the world’s fastest bandwidth growth in recent years, with a four-fold expansion from 2017-2021, according to TeleGeography numbers.

But African nations place low on the global speed rankings. Egypt and Gabon are the highest-ranked in fixed-broadband at 83rd and 89th respectively, while Togo is the highest in mobile, placing 54th.

Google’s Equiano – named after 18th-century Nigerian abolitionist Olaudah Equiano – will run from Portugal to South Africa via Togo, Nigeria, St. Helena and Namibia. It has a design capacity of 144 Tbps.

Originally slated to go into service in early 2022, it is now expected to be commissioned in Q4.

In Nigeria, Africa’s biggest economy, the cable is forecast to shave a fifth off retail internet prices and increase bandwidth six-fold, according to an economic impact analysis.

Google describes it as delivering at least 20 times more bandwidth than any other African cable.

Want to know more? Sign up to get our dedicated newsletters direct to your inbox.

That’s a hefty increment, but even so, it is set to be overshadowed by Meta’s 180Tbps 2Africa system – at 45,000 km, it will be the world’s longest subsea cable.

2Africa will make 46 landings and connect 33 countries, running the length of Africa’s east and west coasts, and with an extension linking India, Pakistan and the Gulf states. Among the African nations, it will connect Kenya, Tanzania, South Africa, Mozambique and Nigeria.

It made its first landing in Genoa in April and looks likely to go live in late 2023 or 2024.

Of course, Google and Meta are no strangers to the subsea capacity business. US internet giants – including Apple, Amazon, Microsoft and Netflix – dominate traffic on the world’s major cable systems, accounting for 76% of trans-Pacific traffic and 92% on Atlantic routes.

Currently, they account for less than half of internet traffic to Africa. That is about to change.